salt tax cap repeal

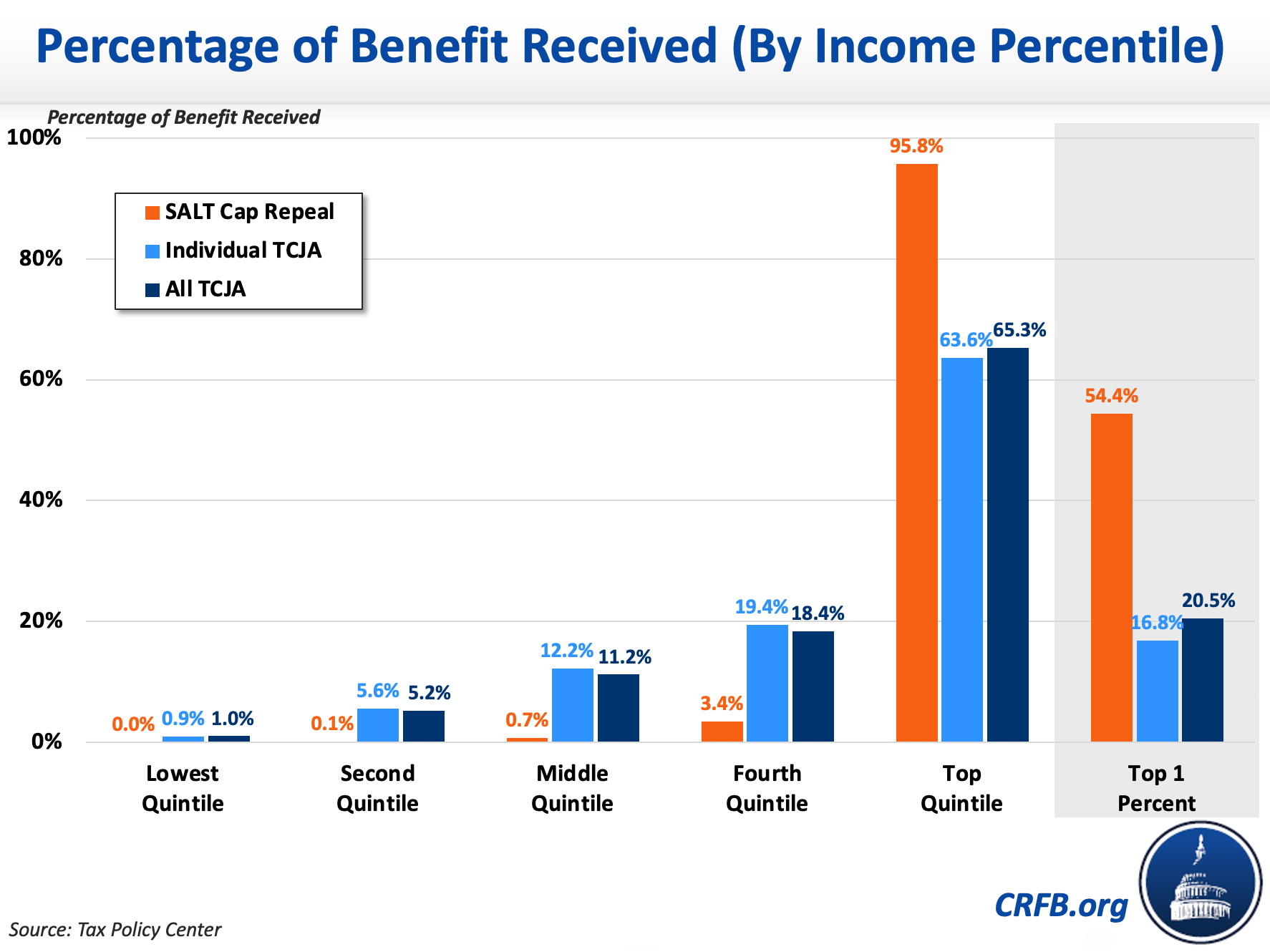

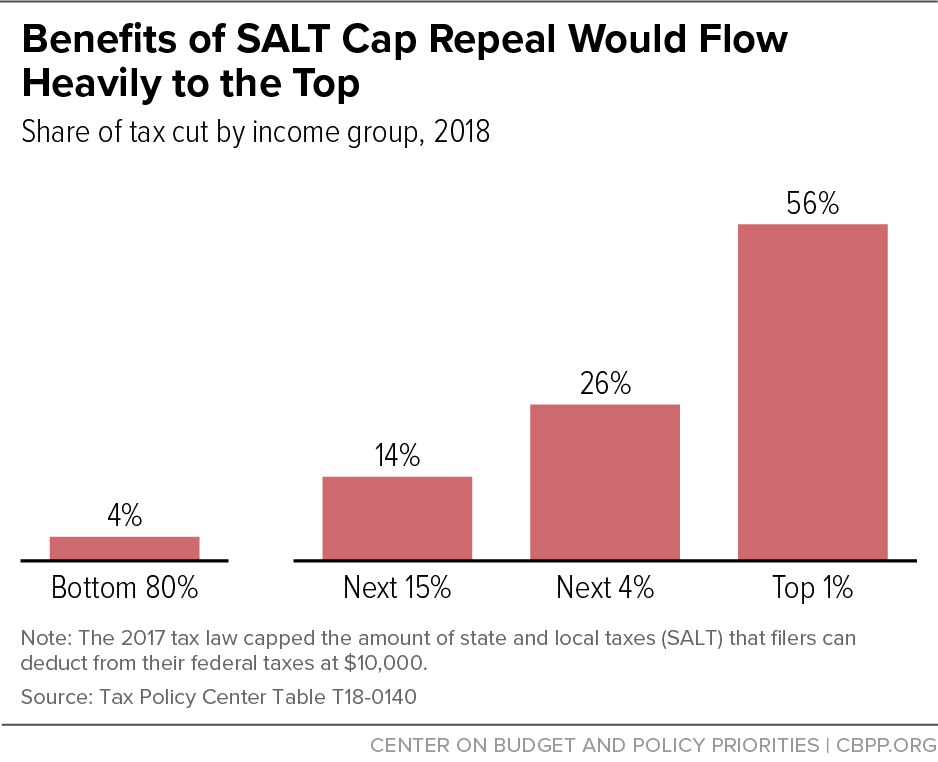

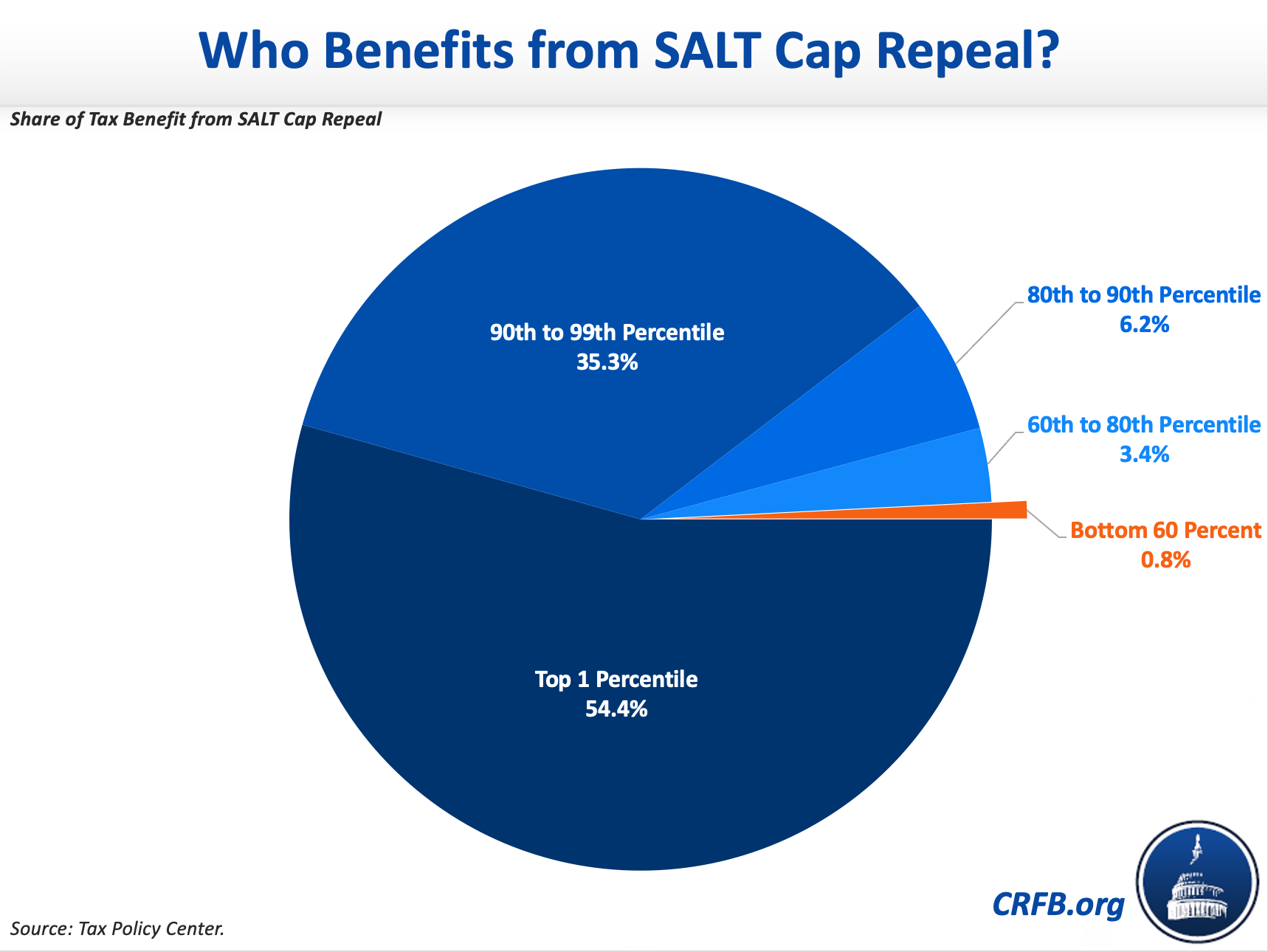

We should be able to deduct our full property tax. Almost all 96 percent of the benef its of SALT cap repeal would go to the top quintile giving an average tax cut of 2640.

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Under a full repeal the top 1 percent of households would receive an average tax cut of at least 35000 compared to a paltry 37 for their middle class.

. The SALT cap repeal would influence taxpayers differently based on itemization status tax bracket and state and local taxes paid. Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax SALT deduction Howard Gleckman an. Legislative efforts to repeal the SALT cap are stalled.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. SALT cap repeal is an example of a policy simultaneously geared toward families with higher incomes and more wealth. SALT Tax Deduction Cap Repeal.

The Tax Foundation predicts that a full repeal of the cap could reduce. As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot Not in these quarters. House Democrats agreed to a compromise that would raise it to 80000 per year but it was part of.

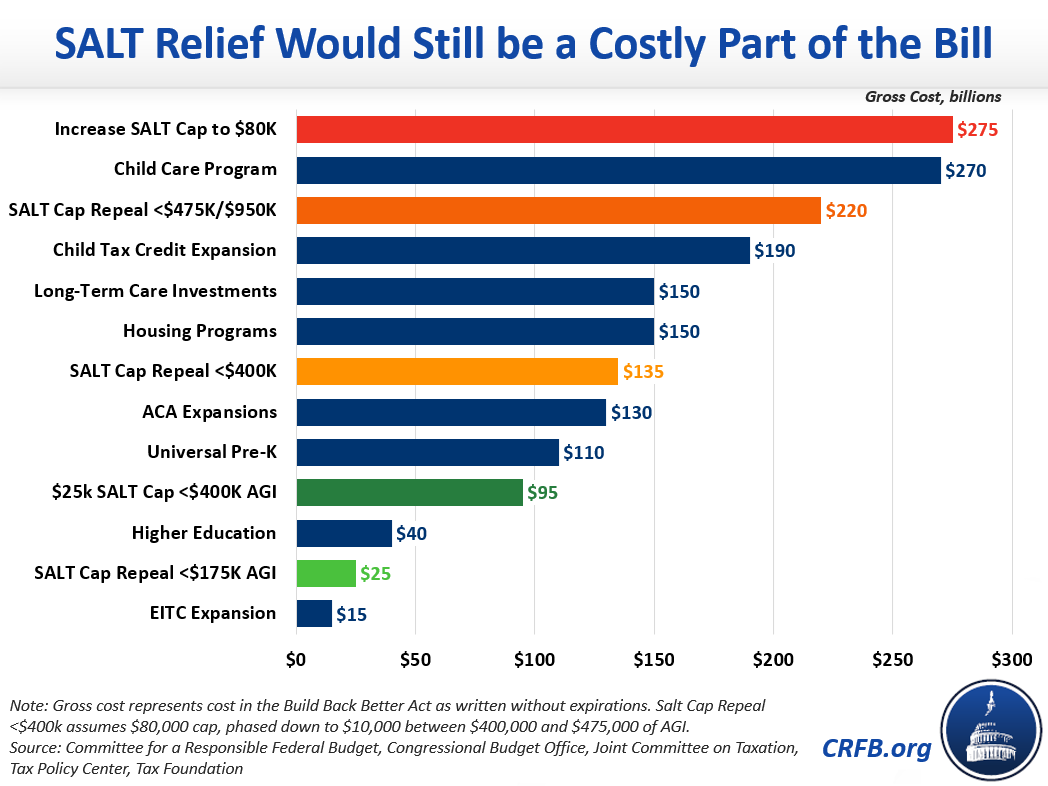

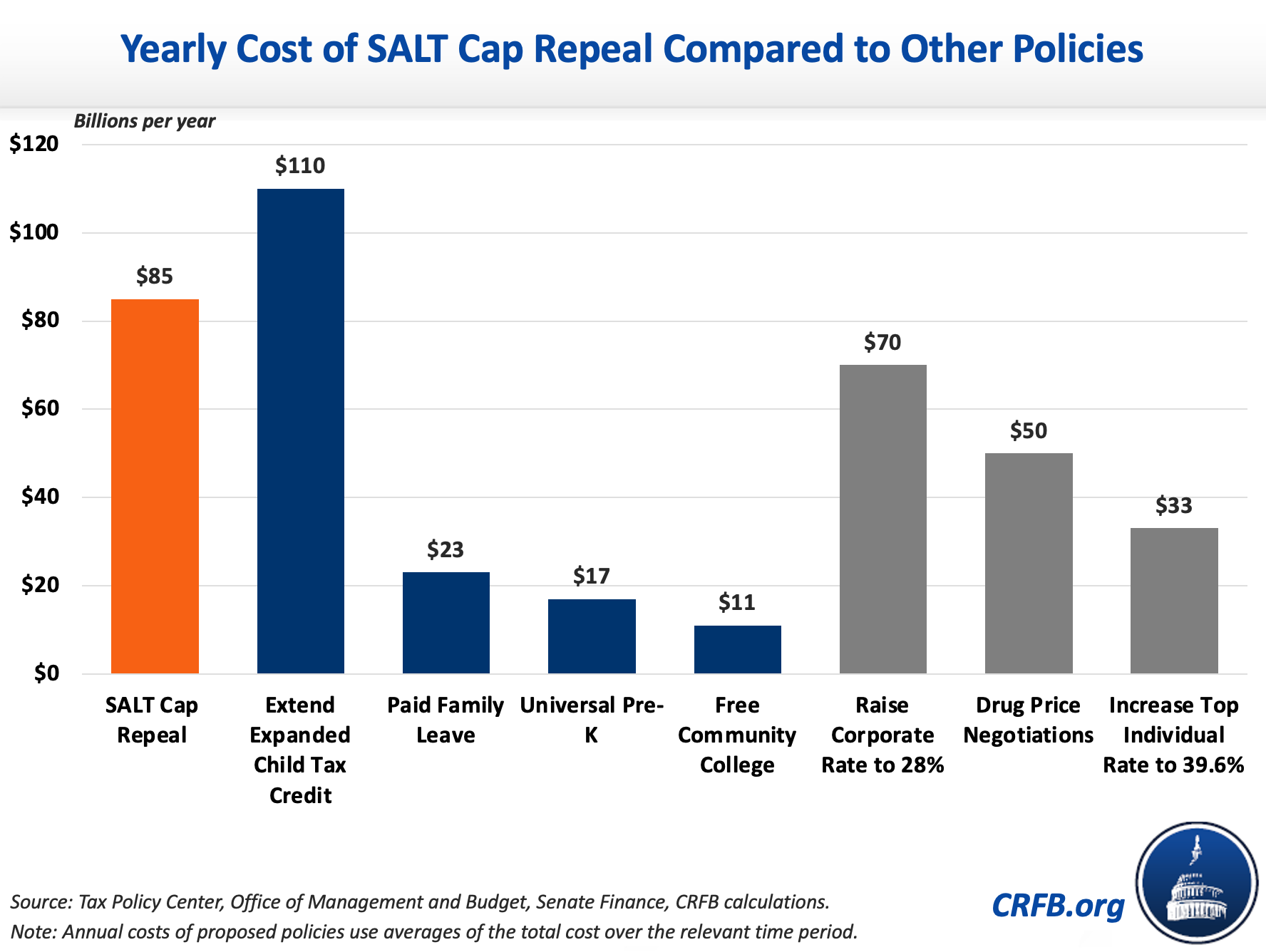

The income tax portion of the SALT deduction is tied closely to families incomes while the property tax portion is tied to homeownership and home value which are major components of overall wealth. A bill from House Ways and Means Chairman Richard Neal and others would modify and then repeal for two years the 2017 tax laws cap on the federal deduction for state and local taxes SALT and offset the cost over ten years by returning the top individual tax rate to 396 percent. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent.

While the effects of the SALT cap deduction differ by location SALT cap repeal is highly regressive in every single state according to the Institute on Taxation and Economic Policy ITEP. There was a provision added to the Build Back Better legislation Bidens SALT Tax that would have raised the limit to 80000. Many New Jersey residents pay more than 10000 in property taxes.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. 57 percent would benefit the top one percent a cut of 33100. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

Representative Josh Gottheimer D-NJ one of the repeals staunchest proponents remarked that reinstating previous SALT deductions would be a boon for struggling families Yet the deductions disproportionately benefit the wealthy. But dont worry Suozzi hasnt forgotten and is making his stand. This bill did get past the Senate and thus this provision did not go into effect.

Though this increase in the SALT deduction cap would be less costly than full repeal it would still cost more. The SALT tax deduction is currently capped at 10000. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus.

11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for. Over 50 percent of this reduction would accrue to. Analyses found that repealing the cap would disproportionately benefit the wealthy.

It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the SALT cap were repealed. Among itemizers those in. Some Democrats look into SALT tax deductions for 35 trillion spending bill.

Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on or after January 1 2021. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction according to. Unless this provision is revived in a future bill the 10000 limit will remain in effect until 2025.

The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is nixed. The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is nixed. In New York for example the top one percent would enjoy almost two-thirds of the benefit with an average tax cut of 93600 per household 146790 inclusive of tax cuts form the TCJA.

The Tax Foundation predicts that a full repeal of the cap could reduce federal revenue by 380 billion through 2025. 54 rows Senate Majority Leader Chuck Schumer D-NY has expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify.

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Pin By Frank Valdez On Coin Sanders Cap Upper Middle Class

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Benefits Of Salt Cap Repeal Would Flow Heavily To The Top Center On Budget And Policy Priorities

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget